What’s the deal with the downtown San Diego real estate market?

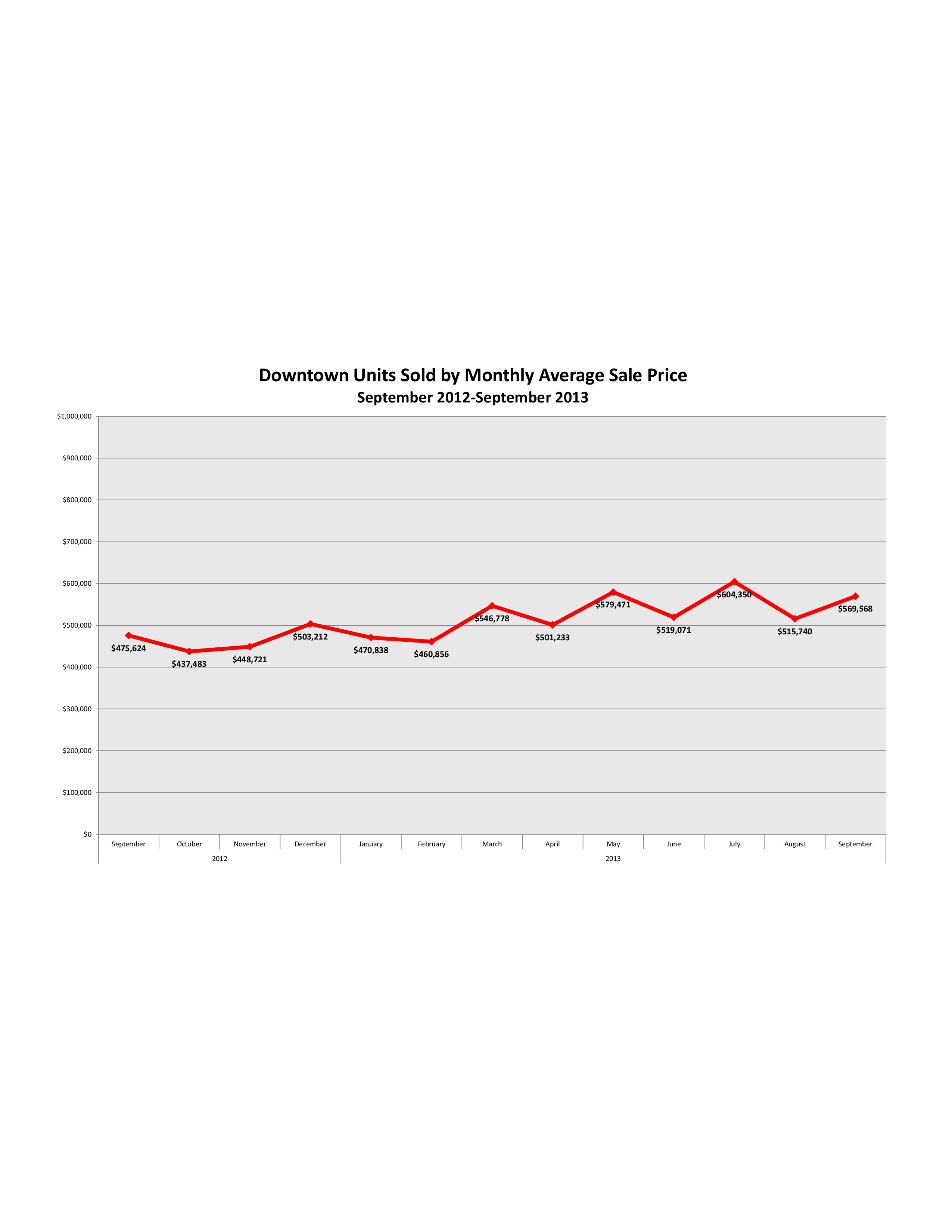

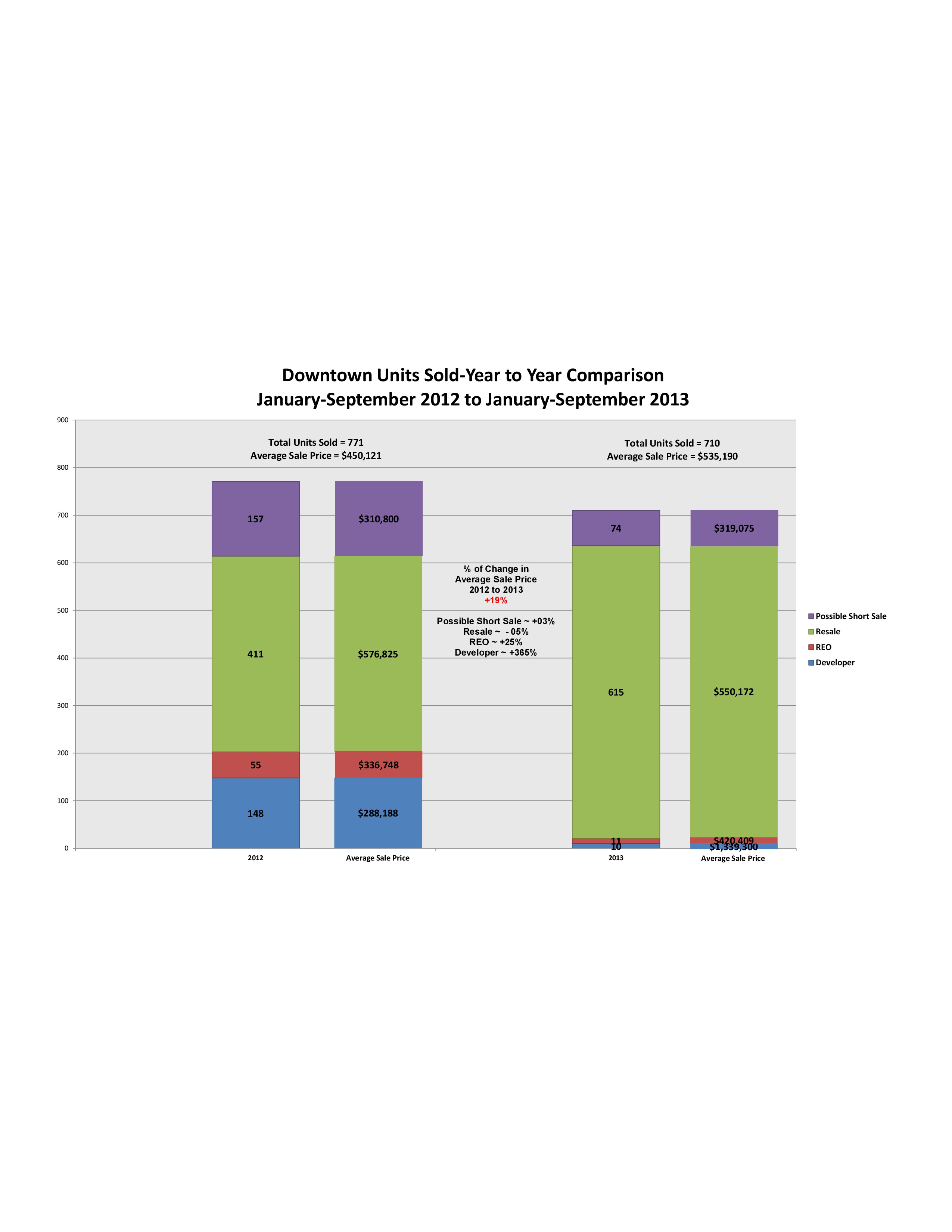

Here’s the scoop on the downtown San Diego real estate market over the past 12 months or so. Late 2012 was slow and boring. At the beginning of 2013, however, we saw multiple offers on listings because interest rates were still in the 3s and 92101 for-sale inventory was only around 150 units. It was a case of low supply, high demand, cheap money, and a lot of buyers who finally realized that they missed the bottom of the market by about 18 months.

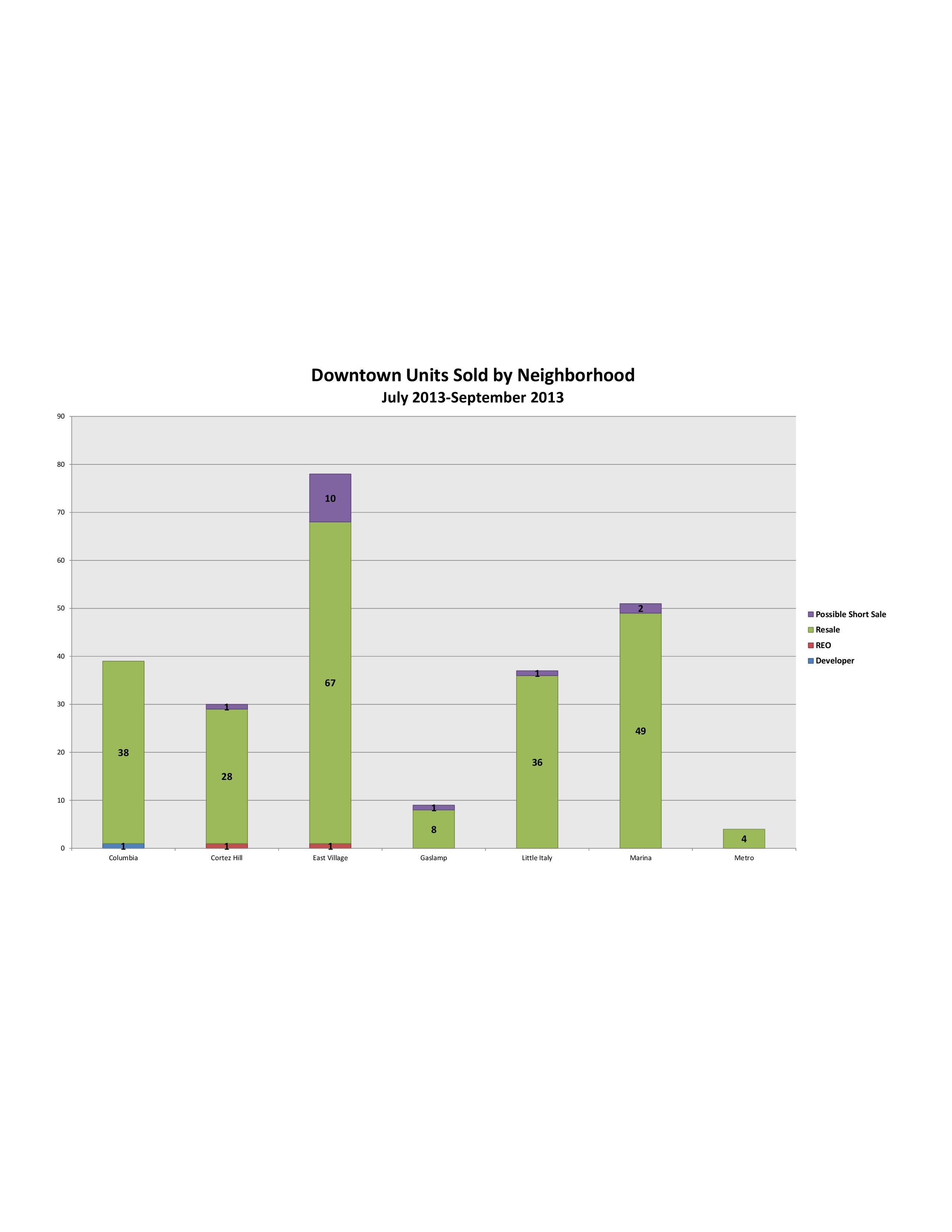

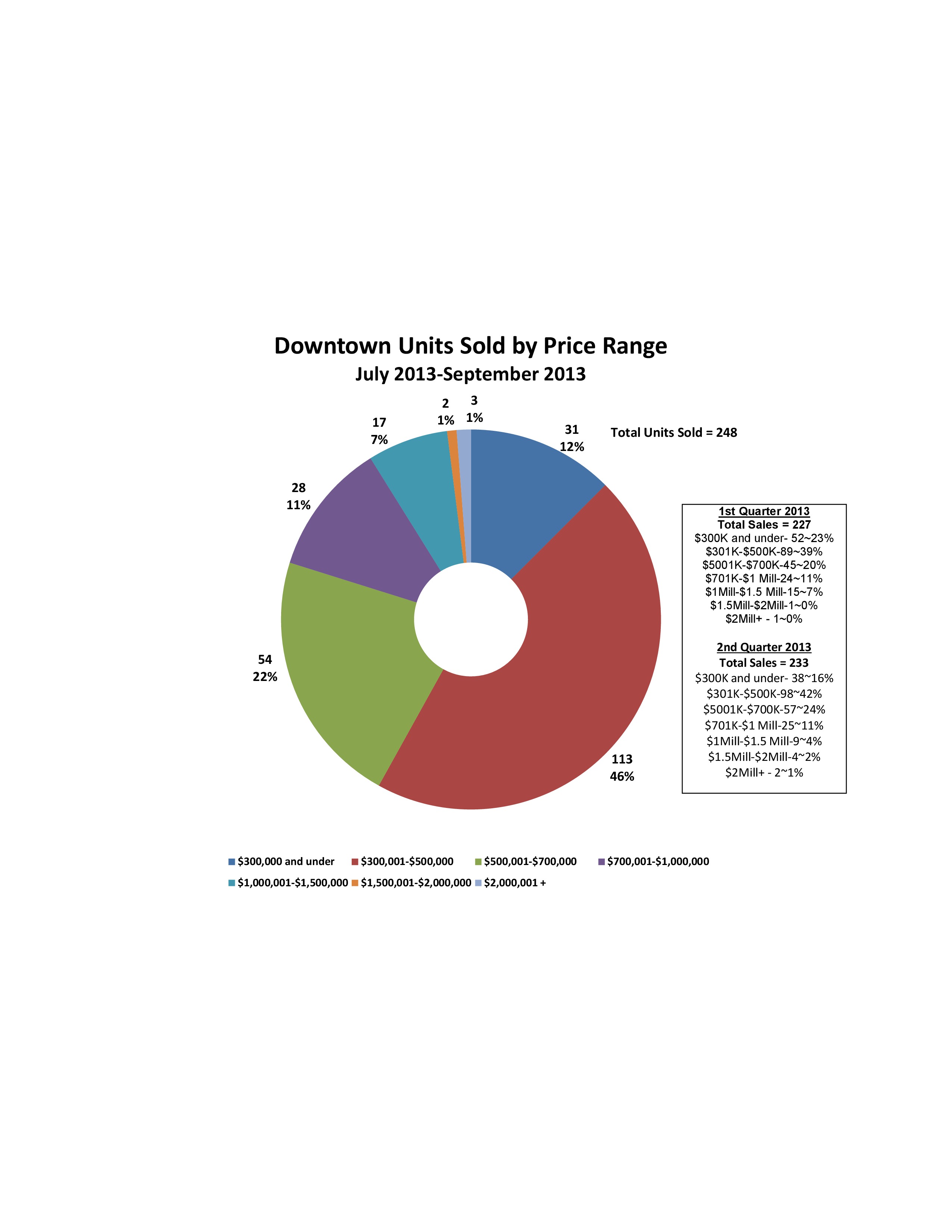

By Independence Day 2013, that frenzy was over. Downtown San Diego condo inventory had increased, and interest rates were into the mid-4s. Lots of buyers went back to fence-sitting which translated into longer market times, decreased showings, and expired listings. As of today, the Sandicor Multiple Listing Service “active” inventory for downtown San Diego real estate is just under 250 units.

So where is this market going? As for inventory, it remains to be seen. The classic pattern is for buyers and sellers to take a break over the holidays and come back in January and February. One thing is for certain – there will be no new construction for sale in downtown San Diego in 2014. And probably not even 2015. (Those cranes you see in Little Italy and the East Village are apartments and City College construction, respectively.) The downtown market is likely to be slow and steady next year. But slow and steady wins the race. And inventory, whether that’s quantity or quality, will likely be the wild card much as it was this year.

What about mortgage interest rates today? Where will they be in 2014? Right now, they are around the mid-4s for a conventional 30-year fixed note. It’s hard to predict the future but given the overall health of the economy, or lack thereof, I wouldn’t expect rates to skyrocket or plummet over the next 12 months. Do you have questions about the downtown San Diego real estate market? Ask 92101 Condo Guru. Have questions about loans and interest rates? Ask a mortgage broker. I like Skip at Park Village Financial. (858) 538-3091 He knows the numbers side of the deal. Feel free to chat him up about surfing and brewing craft beer while you’re at it.